வரி செலுத்துபவர்கள் வரியை குறைக்க மிகவும் முயற்சி செய்வார்கள். அவகர்களது நிலைமை எந்த மருந்தைத் தின்றால் பித்தம் தெளியும் என்பது போல் இருக்கும். அவர்களுக்கு நான் மிகுந்த பக்கவிளைவுகள் இல்லாத பித்தம் தெளியும் மருந்து பற்றி கூறுகின்றேன். அந்த எளிய மருந்து இ.எல்.எஸ்.எஸ் (ELSS) எனப்படும் ஈக்விட்டு லிங்கெட் சேவிங்கிஸ் ஸ்கீம் (Equity Linked Savings Scheme). இந்த மருந்தை எந்த வரி செலுத்தும் வயதினரும் பயன்படுத்தலாம்.

முதலாவதாக, வருமானவரி சட்டத்தில் 1.5 லட்சம் வரை முதலீடு செய்து வரிச் சலுகை பெறலாம். பெரும்பாலோனர் நாடுவது தபால் அலுவலக சேமிப்பு திட்டம், காப்பீடு அல்லது வரி சலுகை உள்ள வங்கி வைப்பு. இவை அணைத்திலும் முதலீடு செய்ய குறைந்த காலம் 5 வருடங்கள். மேற்கூறிய திட்டத்தில் முதலீடு செய்ய குறைந்தபட்ச காலம் 3 ஆண்டுகள் மட்டுமே.

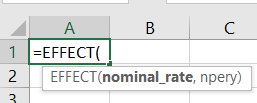

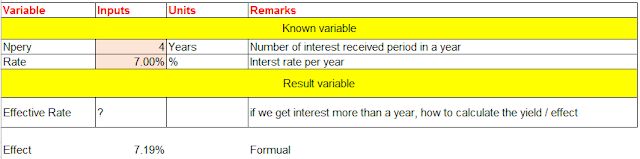

இரண்டாவதாக, வருமான லாப விகிதங்கள் அட்டவணையை பார்க்கவும். வரிச்சலுகையை உள்ள முதலீடுகளில் அதிக லாபம் தரக்கூடிய வகையில் உள்ளது நான் கூறிய இ.எல்.எஸ்.எஸ் (ELSS) என்பது தெளிவாக தெரிகின்றது. இந்த வருமானம் சந்தையின் லாபத்திற்கு ஏற்றவாறு அமையும் என்பது முக்கிய அம்சம். மூன்று வருடங்கள் அவசியம் முதலீடு செய்திருக்க வேண்டிய காரணத்தால் நாம் மூன்று வருட லாப வகிதங்களை அட்டவணையில் தந்துள்ளோம். அது மற்ற வருமானத்தை விட அதிகமாக இருப்பது கண்கூடு.

|

Tax Benefits under sec 80c

|

|||

|

Saving Mode

|

Lock in yrs

|

Returns %

|

Remarks

|

|

ELSS

|

3

|

10.14#

|

Market linked returns

|

|

PPF

|

15

|

7.9

|

|

|

Tax saving FD

|

5

|

6.25 - 7.5

|

|

|

NSC

|

5

|

7.9

|

|

|

ULIP

|

5

|

Market linked returns

|

|

# Average return of 20 ELSS schemes

மூன்றாவதாக, இ.எல்.எஸ்.எஸ் திட்டங்களில் முதலீடு செய்து பராமரிப்பது மற்றும் உபயோகிப்பது மிக மிக எளிது. தற்போது கணணி மயமான உலகத்தில் இந்தத் திட்டங்களை வாங்குவதும் விற்பதும் கணினி மூலமே. இது சிறந்த எளிமையான அம்சமாகும்.

|

5 ELSS funds for your investments

|

3 year returns %

|

|

Mirae Asset Tax Saver Fund - Reg - Growth

|

17.88

|

|

Axis Long Term Equity Fund

|

15.29

|

|

Tata India Tax Savings Fund - Reg - Dividend

|

13.92

|

|

DSP Tax Saver Fund

|

11.05

|

|

IDFC Tax Advantage (ELSS) Fund

|

10.53

|

உங்களுக்கு இக்கட்டுரை பயனுள்ளதாக இருந்தால், இதை உங்கள் பேஸ்புக் அல்லது டுவிட்டரில் பகிர்துந்து கொண்டு, மற்றவர்களையும் பயனடையச் செய்யுங்கள் . நன்றி .